30 and Still Broke

By Charlotte Dallison for The Big Share

Ahh, the 30 year deadline. As you shift gears into this next decade you’re expected to have it all sorted, right? All you need is a banging career, a perfect romantic partner, instagrammable digs (which you preferably own), a balanced, healthy lifestyle (that’s still fun!), plans for a baby soon and, most importantly, a juicy salary and healthy savings account.

But what if you get to 30 and you’re still broke? Not to mention you’re far from ticking off all of the other, aforementioned boxes. Well, that’s what happened to me. Despite having spent my 20s working hard I got to my 30th birthday with very little to show for myself. Not only that, but in missing my 30 year deadline I developed an acute sense of shame at being behind.

All of this got me thinking, why was I so rubbish with money? Why have I never been taught anything about it? Why was I so afraid to ask for what I’m worth?

At my single sex school, and amidst my all-girl upbringing, as a child and teen I was taught very little about personal finance. In fact my only real lesson was that money was a topic best left to blokes. Whilst my generation of women were encouraged to work and to pursue satisfying careers, we were never taught to strive to be a household bread winner/ As for retirement, forget it, the lesson I was taught was that your husband will take care of that.

In fact, as I reflected more, I realised my earliest perception of money was that it equalled clothes. I didn’t know about credit cards as a teen, but I did know about Cosmo magazine. I also knew that in order to buy the gorgeous garments, so aggressively advertised to me amidst it’s pages, that I needed to get a job.

As soon as I could I began working. I started babysitting at age 14, and waitressing at age 15. I then worked in shops, at a salon, even at a sausage stall called Fritz’s Weiners (from which I would come home from a shift stinking like a grease trap).

I worked hard, I liked working, in fact I liked it much more than school. Each week, as the money from my well-earned paycheque would hit my account, I would straight away blow it all on the things that made life worth living; cigarettes, booze, petrol and clothes.

But I never saved a cent. I didn’t know how. I didn’t want to know either. I wanted to work and then I wanted to live. I wanted to keep creating outfits from my thrifted finds, to keep partying, and to keep driving around the small New Zealand city I grew up in until I could make my escape.

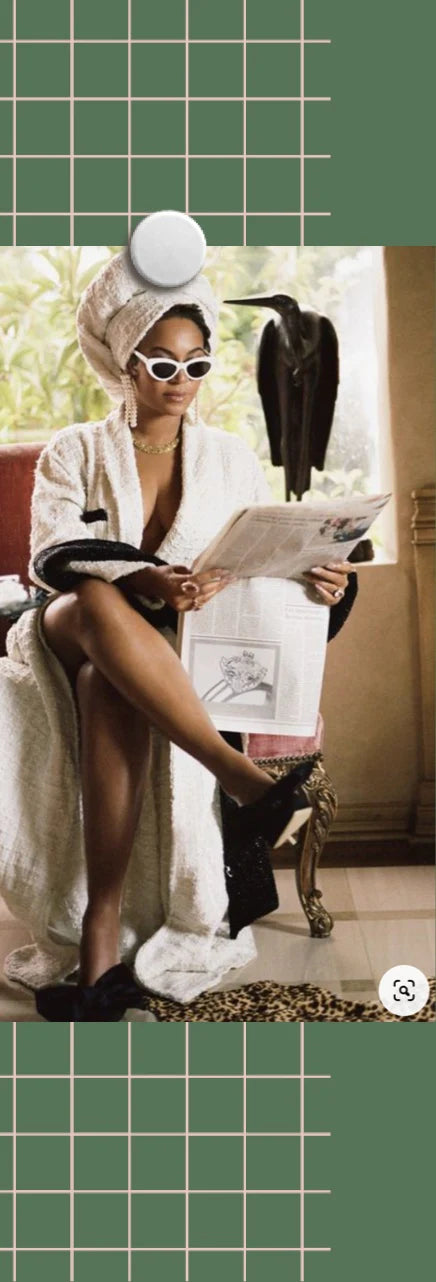

I was doing all of this whilst dreaming about leaving and going to work at a magazine in Sydney or London. As I imagined my fabulous future I would close my eyes and practically hear the click-clack of my grown up high heels on the floorboards of my hypothetical future office. One day I would get to work all of the time and I’d get to buy myself even more clothes!

Then, that day kind of came. By age 20 I was interning at a major magazine in Sydney, by age 22 I was working as a press assistant at a busy fashion office in central London. I managed to do all of the above whilst wearing and hearing those heels I’d previously imagined - heels I could not afford.

I soon realised that in working in fashion and the sinking ship that was traditional media (this was circa 2012, just as blogs began to eclipse everything else) that one was not paid well. In fact sometimes these jobs didn’t pay at all. Sure, through my roles I would occasionally be invited along to some hot press event, but I would then usually spend the night feeling like a dag whilst my senior colleagues would swan around understandably ignoring me.

The insecurity I felt at the time fed the excessive shopping and vice versa. I was always on such measly salaries that I couldn’t get very far at, say, Selfridges. So I kept on op-shopping, scoring gems and looking as lux as possible on a shoestring (hence I’ve now written a book about it!). Yet I still didn’t feel how I wanted to feel - accomplished, elegant and in control - and my bank balance was always awkwardly low.

I also surrendered to the common belief amongst my peers that working in creative industries meant a perpetually low income for me (when, in fact, it should just mean a cycle of manageable highs and lows).

Despite this ongoing pattern I really thought that I might have elevated out of my situation by the time I got to 30. Again, when you get to 30 life is suddenly, miraculously sorted, right? Instead, in August of 2022, I got to 30 still skint. Writing for magazines, sure, but as an underpaid freelancer. In fact last year may well have been my brokest year on the books as I was so focused on writing two manuscripts without any kind of advance until the end of the year.

Sure, I had done a lot with my life come 30. I’d worked in film, fashion and interior design. I had run my own small vintage clothing business and then found my calling in writing. I had lived in four countries, six cities, learnt another language and recovered from a serious injury which almost saw me in a wheelchair for life. Yet I had nothing, literally nothing, to financially show for myself on my milestone birthday. Because of that I felt deeply ashamed, and unable to acknowledge any of my achievements.

After that financial low I continued to berate myself for being broke. Then came the reflection and recently I’ve decided to turn the ship around.

You see the difference is that before I was a dreamer when it came to dosh. I previously thought that I would have got to this age and that my hard work and fabulousness would’ve meant I’d be living in some kind of a hot pink mansion by now. In reality I’ve learnt that true financial wellbeing is much more boring than that. For me it has ultimately come down to my taking responsibility for myself.

Recently I’ve been reading books by financial gurus, subscribing to all kinds of financial wellbeing content (such as that of The Curve), and have generally been spending my money much more mindfully. I’ve even done a huge wardrobe and homewares clear out, selling on all of my PR samples from my fashion and interiors days.

This doesn’t mean I’m living off two minute noodles as I scrimp for the future either. As the writer Emma Goldman once said, “I’d rather have roses on my table than diamonds on my neck.” I agree, although now I’m working on a life in which I can buy a bunch of farm fresh flowers each week and save for an expensive necklace (or, more importantly, my own home).

On my 30th birthday I freaked out when I realised I’d spent all of my money on clothes and cocktails (more so when I compared myself with friends from my conservative hometown who have spent their 20s sensibly saving). Yet today, rather than comparing and despairing, judging or competing, I’m beginning to feel much more empowered. I’m beginning to take the wheel on the unique vehicle that is my personal finances. And guess what, no husband is required.

Substack: Blonde not Beige Mail.

Book pre-order: How To Be Fabulous.

By Charlotte Dallison